Latest Announcements

Fund types varies to suit client’s objectives

Type of Funds

Fund types varies to suit client’s objectives

Development Fund

- Private fund, that will be funded through debt facility or equity investments

- Property Type (A): Built to suit (Secured tenant) where there will be an offtake by leasing/buy back

- Property Type (B): Development of an attractive project that has a great potential of generating income with a clear exit strategy

- Property Type (C): Development of a master plan development that has a potential sell/generate income for a recognized demand

Financing Fund

- Off balance sheet financing, where a property is transferred to a fund and fund will secure a debt facility

- Debt service and a repayment plan will be constructed

Income Generating Fund

- Where single or multiple investors contribute into a fund that will acquire an income generating property

- Investors can benefit from dividends payments and capital appreciation

- A financing facility can be offered to leverage to enhance dividends

REIT Fund

- Where multiple investors pool capital into a trust that invests in a diversified portfolio of income-generating real estate assets.

- Investors can benefit from regular dividend distributions derived from rental income and potential capital gains.

- The REIT structure allows for liquidity through public listings, providing easier entry and exit options for investors.

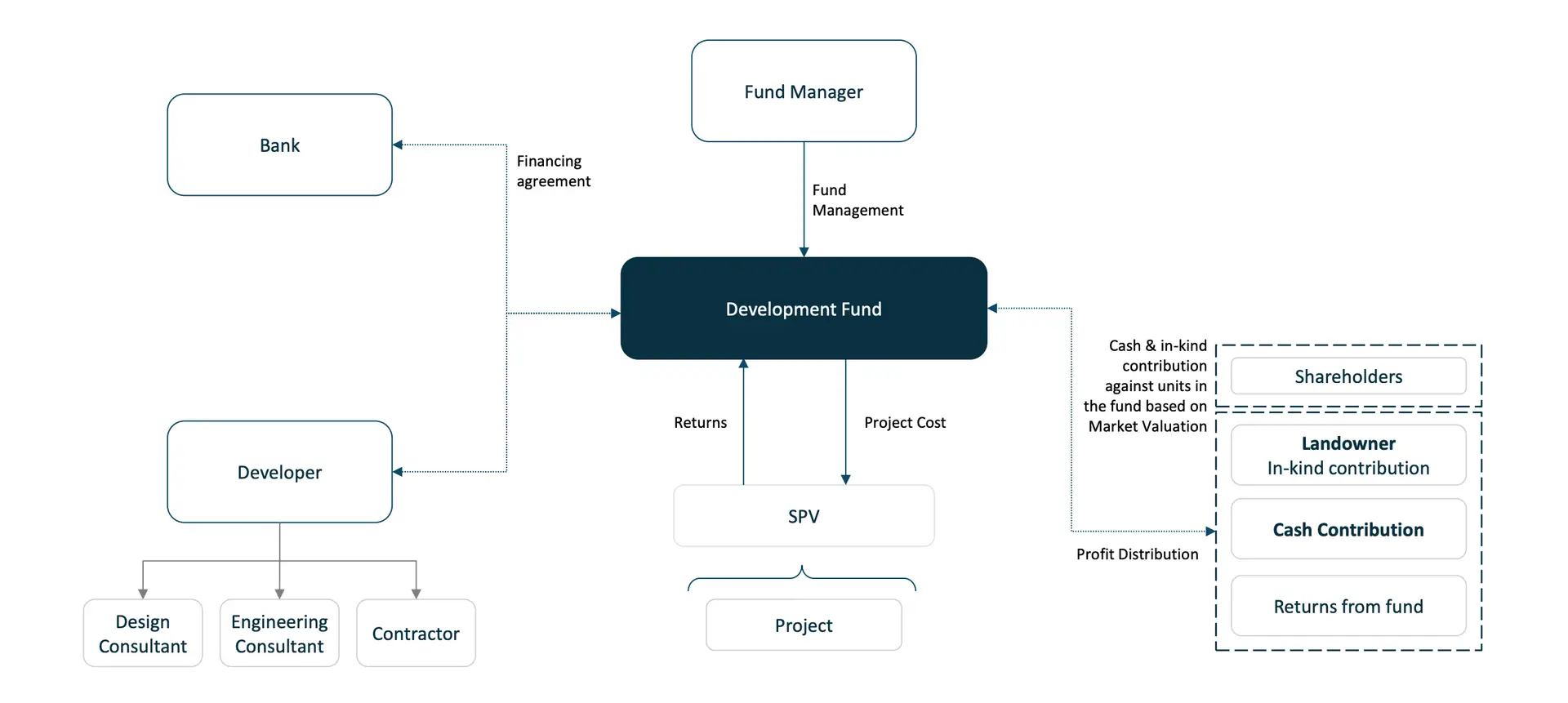

Fund Structure (Private Real Estate Development Fund)

The below chart explain the private real estate development fund structure

Fund Structure (Private Real Estate Development Fund)

The below chart explain the private real estate development fund structure

Potential Service Providers of the Fund

Various stakeholders will contribute to the success of the fund

Tax Advisor

- Advise on valued added taxes of the fund transaction and agreements

- Advise on ZATCA requirement end documentation submissions when required

- Calculate zakat to the fund and prepare for submission to authority “based on clients Preference”

Technical advisor

- To provide the list of entities involved in the development process of the building, i.e. designer, contractor, supervision consultant, etc.

- Verifying Technical Drawings related to Civil, Structural, Architectural, Electromechanical, Fire Fighting, end conduct inspection of it

RE Valuator

- Evaluate the property in line with the governing standards of TAQEEV and requirements of REIT Instructions issued by Capital Market Authority (CMA) for acquisition purposes. Market value shall be the value for which the land should exchange between the seller and the fund in an arm’s length transaction

- The report should clearly outline the valuation method, mechanism and assumptions on which such Valuation is based

Legal Advisor

- Prepare & review the fund’s terms and conditions

- Prepare and review sale end purchase agreement and follow up until the execution of it

- Review the lease contract term, constraint, outline rights of lessee and lessor, break clause (if any). Highlight any legal risk within the contract

- Verifying if the property is subject to the rights of any third party and if there are any covenants, restrictions, burdens, stipulations, easements, grants, conditions, terms, rights or licenses affecting the Land

Custodian

- Maintain accurate and detailed records regarding all changes in the ownership in the title deed and/or other assets related to the investment

- Promptly deliver necessary documentation required by the Fund Manager to fully exercise his right and control of the investment

- Provide duty authorized representative of the Fund Menager with reasonable access to the investment records during the Custodian’s business hours